Bitcoin is the Most Attractive Asset Right Now

As of November 9th, 2022, bitcoin is trading at $15,800 per coin and has a market capitalization of $300B. To put this in context, Bitcoin is about the same size as The Home Depot, but that’s a poor comparison because Bitcoin is not a company; Bitcoin is a hard asset and a payments network. Gold is a more apt comparison. Gold’s market capitalization is estimated to be roughly $11.3 trillion. This makes gold roughly 38 times larger than Bitcoin, despite having inferior monetary properties.

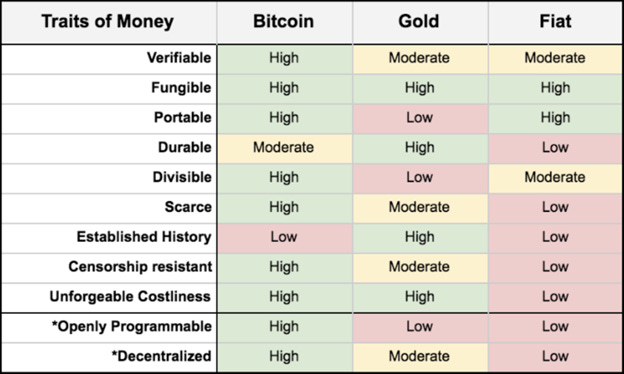

Before I get into why the current global backdrop is an advertisement for Bitcoin, I want to briefly show why Bitcoin has better monetary properties than gold and fiat currencies. Here’s a money characteristic comparison:

Bitcoin's primary weakness is it’s only about 14 years old, but its intrinsic properties make it more attractive than the other things we use as money today. Bitcoin’s ability to be sent around the world, in virtually any quantity, with virtually instant settlement, makes it the prime money for the current global macro and geopolitical backdrop.

The Macro Backdrop

The global economy is showing signs of severe stress. The monetary and fiscal policy response to Covid-19 from governments all around the world was nothing short of colossal. Now it appears a global sovereign currency crisis is upon us. Before I dig deeper into the current environment, I’d like to provide context regarding the United States and the US Dollar’s waning power.

Every great empire throughout history exhibits a similar arc. They help establish a world order and find themselves at the center of global trade. Other governments find themselves trading, saving, and borrowing in the great empire’s currency, creating excess demand for that currency. This is known as a global reserve currency. The great empire inevitably abuses its exorbitant privilege by printing too much money to appease its entitled population. They also tend to outsource productive capacity and find themselves importing more than exporting, also known as a current account deficit. The incessant currency debasement causes foreign governments to wake up and dump the great empire’s currency and bonds. Does that sound familiar?

In most cases of reserve currency collapse, wars break out. Sometimes civil wars and sometimes wars among the great competing powers. Both cases tend to lead to regime change. In times of war, no one wants anyone else’s currency because of a lack of trust and severe currency debasement to pay for the war. As a result, gold often usurps state-issued notes as the pragmatic medium of exchange.

When the wars end, a new world order is established. The war’s winner finds itself at the center of global trade with the ability to print the new world reserve currency. Gold is no longer used as a medium of exchange because it’s expensive to ship, hard to divide, and hard to manipulate the supply to the liking of the empire in charge. As a result, we generally adopt an easily transferable currency redeemable in gold (or other hard assets), until the great empire begins to play with the peg or drops the convertibility window altogether. This creates a fiat currency only backed by trust. Does that sound familiar?

Here's a chart from the IMF showing the dollar’s diminishing role in foreign currency reserves, and this was before 2022 and the war in Ukraine:

To give some color on the lack of demand for US Treasury bonds this year, here’s a 10-year chart of the iShares 20+ year Treasury Bond ETF (TLT):

As you can see, US treasuries are being dumped decidedly. After we sanctioned (or eliminated the value of) Russia’s US treasury holdings, any country out of favor with US politicians began dumping their treasuries at a rapid clip. But it isn’t just foreign adversaries, anyone who doesn’t like earning 4% when inflation is 8% is dumping theirs too.

The Less-Than United States

Given the hostility around the world along with energy and commodity shortages, the United States should probably print cash to revitalize energy, infrastructure, and education while it still has reserve currency status. Americans should probably vote for unifying voices, be honest about their relative standing, and save more. We’re doing none of those things.

A US civil war doesn’t seem outside the realm of possibilities. Perhaps the war in Ukraine develops into a proxy war between the United States and China. Perhaps the United States and China go to war over Taiwan. I don’t know what comes next, but it’s clear things are less predictable and less stable than they were a year ago, or five years ago.

While the future is uncertain, it’s safe to assume the United States continues to lose relevance and economic prowess. America’s budget deficit continues to widen as entitlement spending balloons and tax receipts fall on the brink of a major global recession.

The only way out is to print. Preferably on productive capacity, as mentioned before. The way in which countries (including the United States after WWII) reduce debt burdens is by maintaining negative real yields. Printing cash into inflation leads to higher nominal GDP, and lower real debt. The fixed amount of debt in the system is less burdensome as prices on everything increase. Everyone loses in this situation, particularly bondholders, pensioners, and anyone who is owed money.

Gold has historically performed exceptionally well in times of negative real yields. In fact, gold is essentially a proxy for negative real yields. When bonds have a positive real yield, people tend to want bonds, but when bonds yield less than inflation, people want hard assets.

Anything gold can do; Bitcoin can do better, especially in peacetime. Bitcoin is easy to secure, move, and divide. Bitcoin is scarcer than gold, and it’s not easily confiscatable like gold. As I mentioned at the top, bitcoin would 38x just to catch gold’s market cap.

Come for the War Time, Stay for the Peace Time

What if the world prefers a level playing field? What if no empire is given the exorbitant privilege to debase the global reserve currency? What if price signals relayed dependable information, across time, that could coordinate actual free global trade? What if state-issued currencies are a thing of the past? Bitcoin, or anything quite like it, has never existed during previous regime changes. Maybe this time is different.

According to the OECD, the global broad money supply is roughly $157 trillion. If the world or large swaths of the world adopted bitcoin as a reserve currency, it’s a 500x+ in the price of bitcoin. While the chances of the whole world adopting bitcoin are relatively small, the likelihood of parts of the world adopting bitcoin is quite high. Even if we say 1/3 of the world adopts bitcoin in the next 50 years, that’s almost 200x, which is not a bad risk-reward profile.

In conclusion, the dollar is losing its status as the world reserve currency and gold is a shit way to transact. Bitcoin has a reasonable chance of usurping many of the world’s fiat currencies and becoming the preferred world money. Capitalize on the wider crypto blowup and secure bitcoin in cold storage. Remember, not your keys, not your coins.