I spent the last few weeks deep down the nuclear energy rabbit hole and it’s mind-boggling. I'm considering a 5% investment allocation to the Sprott Uranium Miners ETF (URNM). I’m writing this post to organize my thoughts and expedite my learning process publicly. This is not a recommendation to buy or sell any investment and you should consult with a professional before making investment decisions.

Abundant Affordable Energy Drives Prosperity

Let’s start with the obvious: Affordable and abundant energy is crucial for the advancement of societies. It drives economic growth and development by enabling increased industrial production, increased food production, and efficient transportation, which are critical factors for improving living standards globally.

Reducing Global Carbon Emissions

There is a global effort to reduce carbon emissions in order to address the issue of climate change. Carbon emissions are the primary cause of the greenhouse effect, which leads to global warming and a range of negative impacts such as rising sea levels, more frequent and severe weather events, and damage to ecosystems and natural resources.

To combat these effects, many countries around the world have committed to reducing their carbon emissions through various initiatives, policies, and agreements. For example, the Paris Agreement, which was adopted by nearly every country in the world in 2015, sets a goal to limit global warming to well below 2 degrees Celsius above pre-industrial levels. This requires countries to set targets for reducing their greenhouse gas emissions and take action to achieve those targets.

Additionally, many countries and regions have set their own targets for reducing emissions, such as the European Union's goal of achieving net-zero greenhouse gas emissions by 2050. Many companies and industries are also committing to reducing their emissions through various initiatives and programs, as they recognize the risks and opportunities associated with climate change.

One of the most significant steps towards reducing carbon emissions is to transition to clean energy. This means increasing the use of renewable energy sources, such as wind, solar, nuclear, and hydropower, which do not emit greenhouse gases.

Baseload Power Generation

There’s a common misunderstanding that energy can be stored on an electrical grid; this is mostly false. Perhaps energy storage becomes viable over the coming decades, but today grids operate by generating electricity at virtually the same time as that electricity is consumed. Energy production and consumption are also geographically bound because electricity can only be transported a couple of hundred miles before the energy losses become too significant.

Unfortunately, the sun isn’t always shining and the wind isn’t always blowing everywhere. Instead of a dramatic overbuild of wind and solar to account for the intermittency of sun and wind, a little baseload generation provides a stable source of electricity to meet the constant demand for energy. Wind and solar power can be seen as complementary sources that can help to reduce the reliance on fossil fuels but won’t lead to a reliable and stable grid on their own.

Nuclear Energy is the Densest Form of Baseload Generation

Nuclear fuel, in the form of enriched uranium, has an extremely high energy density compared to other fuels, such as coal and natural gas.

For example, a single kilogram of enriched uranium can produce as much energy as several thousand kilograms of coal or natural gas. This high energy density makes nuclear power an attractive source of energy, as it allows for the efficient generation of large amounts of electricity using relatively small amounts of fuel.

"Nuclear power is one hell of a way to boil water." - Albert Einstein

Nuclear is Carbon Free

Nuclear energy is a carbon-free source of energy. During the operation of a nuclear power plant, no carbon dioxide or other greenhouse gases are released into the atmosphere.

This is in contrast to other sources of energy, such as coal and natural gas, which release significant amounts of carbon dioxide and other pollutants when burned to produce electricity.

Nuclear is Safe

There have been fewer human deaths attributed to nuclear energy than almost all other forms of energy generation. Ranked by deaths per terawatt-hour (TWh), Nuclear is 2nd only to solar:

The Resurgence of Nuclear Energy

Nuclear energy is becoming a major part of the Environmental, Social, and Governance (ESG) framework, which is used to evaluate the sustainability and ethical impact of investments.

US politicians are increasingly in support of the continued use of nuclear energy, arguing that it is a critical source of carbon-free electricity that can help address the impacts of climate change. Bill gates’ company, Terrapower, is also looking to build advanced nuclear reactors across the United States in the coming decades.

According to the World Nuclear Association, there are currently 440 nuclear reactors in operation globally, with another 60 under construction. As these reactors come online, the demand for uranium is expected to increase, especially as the world moves towards a low-carbon energy future. Additionally, uranium is not just used for power generation; it also has industrial applications in the aerospace, defense, and medical industries.

See reactors under construction worldwide as of May 2022, by country:

Uranium Supply Shortfall

Uranium is a naturally occurring radioactive element that has been used to generate electricity in nuclear power plants for decades.

The supply of uranium is limited and subject to geopolitical risks. The production of uranium is concentrated in a few countries, namely Kazakhstan, Canada, and Australia. This concentration of supply leaves the market vulnerable to disruptions, such as political instability or natural disasters, which can cause the price of uranium to spike. Recently, nuclear fuel buyers are increasingly looking to purchase fuel from outside of Russia and Kazakhstan, both major suppliers in today's market, after Russia's invasion of Ukraine.

According to the International Atomic Energy Agency (IAEA), the recent annual production of uranium metal worldwide has been between 55,000 and 65,000 tons. The World Nuclear Association reports that the current global fleet with a combined capacity of about 390 GWe, requires 74,000 tons of uranium.

in 2020, mine production of uranium covered only 74% of global reactor requirements and the shortage of uranium is poised to get worse:

Global Energy Shortage

Energy markets began to tighten in 2021 because of the rapid economic rebound following the Covid pandemic. Then the situation escalated dramatically into a full-blown global energy crisis following Russia’s invasion of Ukraine in February 2022. The price of natural gas reached record highs, and as a result, so did electricity in some markets. Oil prices hit their highest level since 2008. Now in early 2023 China is abandoning its zero-Covid policies, which should significantly increase global energy demand.

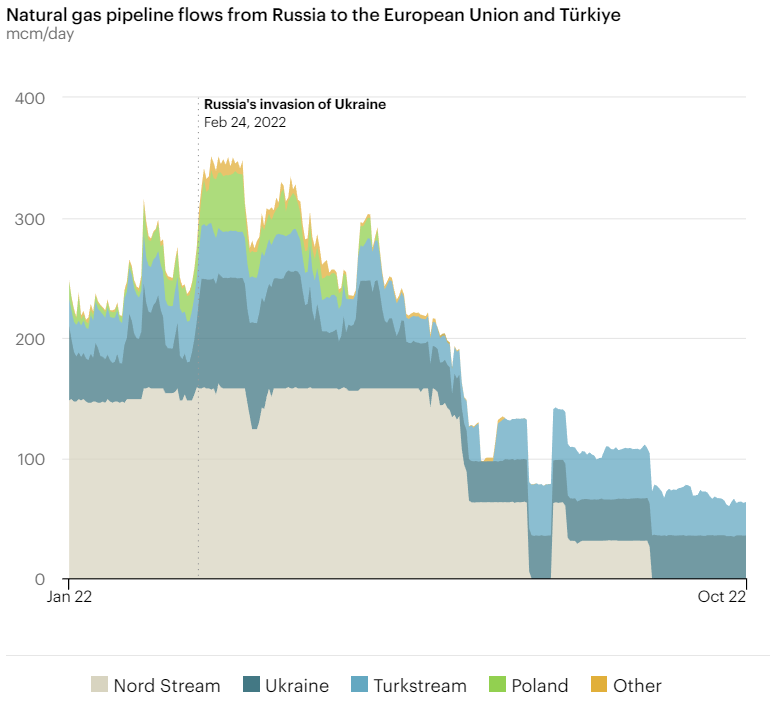

Higher energy prices have contributed to painfully high inflation, pushed families into poverty, forced some factories to curtail output or even shut down, and slowed economic growth to the point that some countries are heading toward recession. Europe’s gas supply is uniquely vulnerable because of its historic reliance on Russia. Russia has cut off natural gas pipeline flows to Europe by 80%:

The price of uranium does not necessarily correlate with the overall economy, as it is primarily influenced by factors specific to the nuclear energy industry, such as changes in nuclear power capacity, supply and demand imbalances, and political and regulatory changes. All that said, it’s unlikely we’ll see generally low energy prices with the disruptions in the global energy markets. This should bode well for uranium demand.

Diversification Benefits

As someone with a large allocation to global equities and bitcoin, Uranium provides highly differentiated returns, which I find attractive in this market. Here’s the long-term price history of Uranium:

And here’s the S&P 500 over a similar timeframe:

I couldn’t find a way to overlay those charts, but it’s clear that the two do not correlate much.

While there may be some indirect linkages between uranium prices and the economy, the primary drivers of uranium prices are industry-specific factors and not broader economic factors. It is important for investors to focus on developments specific to the nuclear power industry when considering uranium as an investment.

Valuations indicate the expected forward returns in US stocks are less than enticing at the moment so I’m keen to own non-correlated assets like uranium. If one market is experiencing a downturn, the other may be performing well. By holding global equities, bitcoin, and uranium miners, I’m hoping to reduce the overall risk in my portfolio.

Trade Expression

I’m considering a 5% (of investable net worth) allocation to the Sprott Uranium Miners ETF (URNM). I’m expecting this to be a 2-5 year investment depending on how supply and demand dynamics play out. Commodity price cycles are often pronounced to the upside and downside because supply is often slow to adjust to demand. It’s important to monitor where you think you are in the cycle. I guess we are around the 4th inning of this uranium bull market.

While I’m not necessarily expecting a 2007-like blow-off top, I wouldn’t be surprised to see the price of Uranium rise 50-100% in the coming years. With the Nuclear/ESG narrative taking hold (for good reason) and with global energy insecurity, the demand will be there and I see little indication that the supply can keep pace.

I don’t want single-stock risk when this is a uranium price play and I’m a tourist in the space. I don’t care for nuclear ETFs with a lot of exposure to electric utilities that operate nuclear reactors for a state-mandated profit. Finally, nuclear technology companies are interesting to me, but that’s a different trade for another day.

The Sprott Uranium Miners ETF (URNM) checks all the boxes. It provides broad exposure to an index that’s designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development, and production of uranium, or holding physical uranium, owning uranium royalties, or engaging in other, non-mining activities that support the uranium mining industry.

Also, the URNM price chart looks attractive:

Risks

Geopolitical Risk: Given the uncertainty in the global energy markets and sanctions being shared liberally, there are risks I cannot even picture right now. A bifurcated uranium supply chain seems like a very immediate risk.

Economic Risk: Macroeconomic conditions are tepid and there’s a moderate possibility of a global recession. A global recession could lead to less energy demand and lower uranium prices.

Nuclear Reactor Meltdowns: Any time a nuclear reactor melts down, it’s a huge deal. There are 440 nuclear reactors operating so there are 440 chances of something going wrong. Nuclear energy safety has come a long way since the most notable meltdowns in history, and even after accounting for deaths from those meltdowns, nuclear is remarkably safe, but meltdowns are scary nonetheless.

Energy Storage Advancements: If there were to be monstrous innovations in energy storage or transmission, perhaps people would lobby for electric grids powered entirely by wind and solar, but this is a risk almost not worth mentioning.

Conclusion

The world needs more energy. Carbon-free baseload power generation is the perfect complement to the wind and solar buildout currently in motion all around the world. With the current global energy shortage as well as nuclear energy’s newfound inclusion in ESG frameworks, uranium demand is set to increase rapidly which is likely to cause higher prices. The Sprott Uranium Miners ETF (URNM) provides broad exposure to uranium mining companies that are likely to reap the rewards of higher uranium prices.

Disclaimer: I have a 0.75% position in URNM and I’m legging into the position slowly as I learn more.