Thoughtful Asset Allocation for 2023 & Beyond

What's Replacing the 60/40?

If you’re an investor and haven’t read Global Asset Allocation by Meb Faber, I highly recommend it. It’s available for free here. It’s a survey of the world’s top investment strategies from 1973-2013 and inspired this post. While Global Asset Allocation is a top resource for anyone interested in the nuances of leading investment philosophies and their modern-historical performance, nothing can tell us the right asset allocation for 2023 and beyond.

In this post, I’ll describe and argue for an asset allocation that should provide superb risk-adjusted returns moving forward:

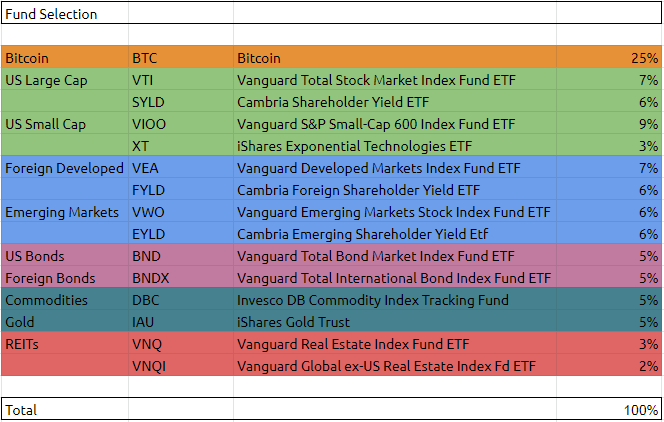

Here it is expressed in an easy-to-implement ETF (& BTC) portfolio:

The Elephant in the Room: Bitcoin

Folks in my industry of traditional finance are likely to scoff at a 25% allocation to bitcoin. To those of you, here’s why the bitcoin allocation is so large:

Americans and most westerners think of bitcoin as a pet rock or an alternative asset to speculate on. It’s easy to overlook or forget that 70% of people on earth, or roughly 5.6 billion people live under a dictatorship. The vast majority of these people constantly deal with various forms of financial repression including capital controls, transaction surveillance & censorship, inability to open bank accounts, asset confiscation, and hyperinflation. People all around the world are adopting bitcoin out of basic necessity.

People often reject bitcoin as a “store of value” because of its volatility in USD terms. It’s easy to forget how attractive bitcoin must look to people in Venezuela, Syria, Zimbabwe, Argentina, Turkey, and many other counties where inflation ranges from 50% to 1200% per year. How about the value bitcoin poses to people evading dangerous situations and crossing borders with their family’s wealth mostly intact?

Bitcoin adoption in the US is largely driven by fear, greed, and speculation, but adoption in emerging and frontier markets follows a very consistent trajectory. Bitcoin’s price will grow sustainably higher as global adoption goes from the current ~1.5% to 5%-10% over the coming decade. The people that need bitcoin will adopt it first and the people who don’t need it hopefully, learn to want it before it’s too late.

Here’s a chart showing bitcoin wallet addresses as of November 2022, which marks the lowest prices bitcoin hit in the current cycle following a series of large high-profile bankruptcies and Ponzi collapses in the wider crypto space. While bitcoin’s price plummeted, wallet addresses holding more than one bitcoin increased rapidly. I don’t see the media reporting on bitcoin’s relentless adoption in the face of adversity.

Whether bitcoin’s network becomes the rails for international settlements and whether bitcoin finds itself on the balance sheet of central banks is superfluous to the central thesis. Those low-probability outcomes are juiced-up call options on an asset that’s already likely to compound quicker than other asset classes. Currently, Bitcoin’s global adoption exceeds the internet’s adoption in the late 90s and only about 1.5% of people on earth use bitcoin today:

If you’re looking for more color on my long-term bitcoin bull case, see:

One Half Stocks

25% of the portfolio is allocated to US stocks and 25% is allocated to international stocks. Home-country bias is a rampant issue in portfolios everywhere. No one is immune to huge drawdowns in home-country stocks, especially Americans with one of the most expensive stock markets in the world. I would prefer to weigh international stocks more given their lower valuations, but this is meant to be a decades-long asset allocation so I’m limiting the influence of current market conditions.

You’ll see I choose to include Cambria funds, in addition to lower-cost Vanguard, iShares, and Invesco funds. Cambria’s shareholder yield strategy is a brilliant quality screen and well worth the 0.59% fee.

Bonds…

As we enter a multipolar global system, US and most other indebted western government bonds are unlikely to produce attractive returns. These countries responded to Covid by printing heaps of money and running massive deficits. Now, years later, the obligations haven’t come down and debts have grown enormously. Governments will need to inflate their currencies to fund entitlements and basic expenses over the coming decades.

Bonds have a 10% allocation as a rebalancing tool and not much more. Vanguard Total Bond Market ETF (BND) & Vanguard Total International Bond ETF (BNDX) provide broad exposure to government and corporate bonds with 6.5-7.5 average durations. Bonds will surely exhibit a timely inverse correlation at some point in the future!

The Rest

Most of the money printing is still ahead of us. Stimulus is like a drug and governments are spending addicts. Commodities, gold, and global real estate are likely to outperform bonds over the coming decade while providing non-correlated returns.

Disciplined rebalancing is at the crux of managing a broadly diversified portfolio of various different asset classes. There are so many approaches to rebalancing but I like quarterly rebalancing on arbitrary days.

Backtest

The point of this post is to advocate for an asset allocation for the future, however, here’s a backtest to give us an idea of what recent history would have looked like. This particular allocation, rebalanced quarterly, had the following characteristics backtested to July 2016, when the Cambria Emerging Shareholder Yield ETF (EYLD) debuted:

A 1.03 Sharpe isn’t shabby. The CAGR and standard deviation are quite high. The Sharpe goes up with less frequent rebalancing, but most investors don’t want to stomach the raw volatility of bitcoin dominating their portfolio. I’d also argue this is near the bottom of a gruesome bear market in bitcoin, and the numbers still look solid. I’ll run these numbers again after the next bull market in bitcoin.

This is the asset allocation I’ll employ in investing my own money moving forward, however, I’ll utilize more individual stocks and fewer ETFs.

Not bad, no value add to others? Would 3rd world be interested in coins that cost less to transfer like AVAX or SOL in the end? No love for ETH?